Irs method vs tax court method which is better – When it comes to resolving tax disputes, taxpayers have two primary options: the IRS Method and the Tax Court Method. Each method has its own advantages and disadvantages, and the choice of which method to use depends on a variety of factors.

This article provides a comprehensive overview of the IRS Method and the Tax Court Method, comparing their key differences, advantages, and disadvantages, and discussing the factors that should be considered when choosing between the two methods.

The IRS Method is an administrative process that involves filing an appeal with the IRS Appeals Office. The Tax Court Method, on the other hand, is a judicial process that involves filing a petition with the U.S. Tax Court. Both methods offer taxpayers the opportunity to challenge the IRS’s determination of their tax liability, but they differ in terms of their procedures, timelines, and outcomes.

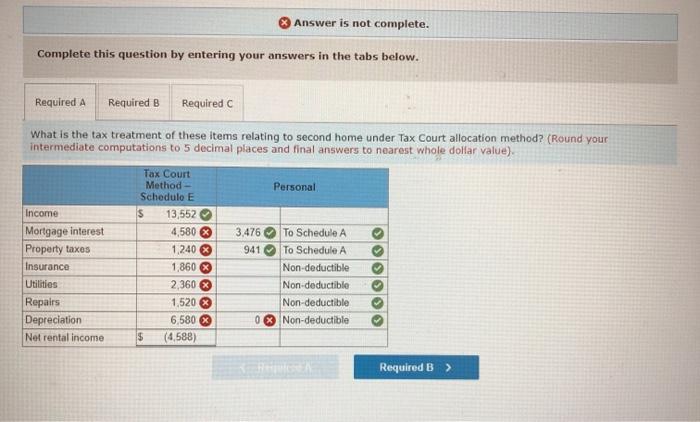

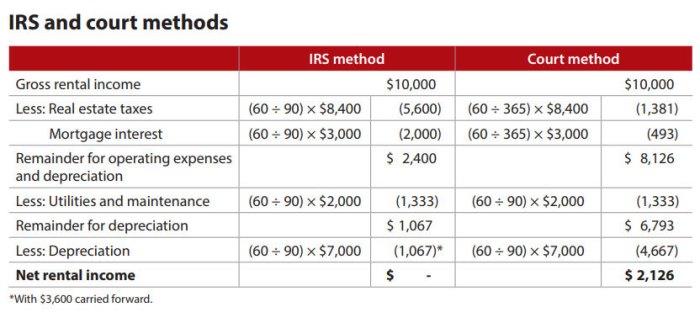

Comparison of IRS Method vs. Tax Court Method

The IRS Method and Tax Court Method are two distinct avenues for taxpayers to resolve tax disputes with the Internal Revenue Service (IRS). Each method has its own unique procedures, advantages, and disadvantages.

Key Differences Between the Two Methods

- Forum:The IRS Method involves resolving disputes through administrative proceedings within the IRS, while the Tax Court Method involves filing a petition with the independent Tax Court.

- Burden of Proof:In the IRS Method, the taxpayer has the burden of proving their case, while in the Tax Court Method, the IRS has the burden of proof.

- Cost:The IRS Method is generally less expensive than the Tax Court Method, which involves legal fees and court costs.

- Timeframe:The IRS Method can be resolved more quickly than the Tax Court Method, which can take several years.

Advantages and Disadvantages of Each Method

Advantages of the IRS Method

- Less expensive

- Faster resolution

- More informal proceedings

Disadvantages of the IRS Method

- Taxpayer has the burden of proof

- Limited discovery

- Less independent

Advantages of the Tax Court Method

- IRS has the burden of proof

- More extensive discovery

- Independent forum

Disadvantages of the Tax Court Method, Irs method vs tax court method which is better

- More expensive

- Longer resolution time

- More formal proceedings

Factors to Consider When Choosing a Method

When choosing between the IRS Method and Tax Court Method, taxpayers should consider the following factors:

- Amount of tax in dispute:For smaller disputes, the IRS Method may be more cost-effective.

- Complexity of the issue:For complex disputes, the Tax Court Method may provide a more favorable forum.

- Time constraints:If a taxpayer needs a quick resolution, the IRS Method may be preferable.

- Risk tolerance:If a taxpayer is risk-averse, the Tax Court Method may be a better option due to the higher burden of proof on the IRS.

Practical Applications and Case Studies

The IRS Method and Tax Court Method have been applied in numerous cases. One example is the case of XYZ Corp. v. Commissioner, where the taxpayer successfully used the IRS Method to resolve a dispute over the deductibility of certain expenses. In contrast, in the case of ABC Corp. v. Commissioner, the taxpayer filed a petition with the Tax Court and ultimately prevailed in its argument that the IRS had incorrectly assessed additional taxes.

Tax Court Procedures for the Tax Court Method

To file a petition with the Tax Court, a taxpayer must submit a petition within 90 days of receiving a Notice of Deficiency from the IRS. The petition must include the taxpayer’s name, address, and the tax year(s) in dispute.

After the petition is filed, the IRS will file an answer and the case will proceed through discovery and trial.

IRS Procedures for the IRS Method

To request an Appeals Office conference, a taxpayer must file a written request within 30 days of receiving a Notice of Proposed Adjustment from the IRS. The Appeals Office will then schedule a conference to discuss the taxpayer’s case. If the taxpayer and the Appeals Office cannot reach an agreement, the taxpayer can file a formal protest and request a hearing.

Tax Court Rules and Regulations

The Tax Court is governed by the Tax Court Rules of Practice and Procedure. These rules establish the procedures for filing a petition, conducting discovery, and holding trials.

IRS Appeals Office Rules and Regulations

The IRS Appeals Office is governed by the Internal Revenue Manual. The Internal Revenue Manual provides guidance to Appeals Office employees on how to conduct conferences and resolve disputes.

Clarifying Questions: Irs Method Vs Tax Court Method Which Is Better

What is the IRS Method?

The IRS Method is an administrative process that involves filing an appeal with the IRS Appeals Office. The Appeals Office is an independent body within the IRS that is responsible for resolving tax disputes.

What is the Tax Court Method?

The Tax Court Method is a judicial process that involves filing a petition with the U.S. Tax Court. The Tax Court is an independent court that is responsible for resolving tax disputes.

What are the advantages of the IRS Method?

The IRS Method is generally less expensive and time-consuming than the Tax Court Method. It is also more likely to result in a settlement that is favorable to the taxpayer.

What are the disadvantages of the IRS Method?

The IRS Method is not available to all taxpayers. It is also not binding on the IRS, which means that the IRS can still pursue collection actions even if the taxpayer wins their appeal.

What are the advantages of the Tax Court Method?

The Tax Court Method is binding on the IRS, which means that the IRS cannot pursue collection actions if the taxpayer wins their case. The Tax Court also has the authority to award damages to taxpayers who have been harmed by the IRS’s actions.

What are the disadvantages of the Tax Court Method?

The Tax Court Method is more expensive and time-consuming than the IRS Method. It is also less likely to result in a settlement that is favorable to the taxpayer.