Fitz Company reports the following information, offering a comprehensive insight into the company’s financial health and performance. This report delves into various financial statements, analyzing key trends and ratios to provide a thorough understanding of Fitz Company’s financial standing.

The financial statements provide a detailed overview of the company’s financial position, profitability, and cash flows. The income statement highlights revenue, expenses, and net income, while the balance sheet summarizes assets, liabilities, and equity. The cash flow statement presents insights into the company’s cash inflows and outflows from operating, investing, and financing activities.

Financial Statements: Fitz Company Reports The Following Information

Fitz Company reports the following financial statements: income statement, balance sheet, and cash flow statement. These statements provide a comprehensive overview of the company’s financial performance and position.

Income Statement, Fitz company reports the following information

The income statement reports the company’s revenues, expenses, and net income over a specific period of time. It shows how the company generates revenue and how it uses that revenue to cover expenses and generate profit.

Balance Sheet

The balance sheet provides a snapshot of the company’s financial position at a specific point in time. It reports the company’s assets, liabilities, and equity, which provide insights into the company’s resources, obligations, and ownership structure.

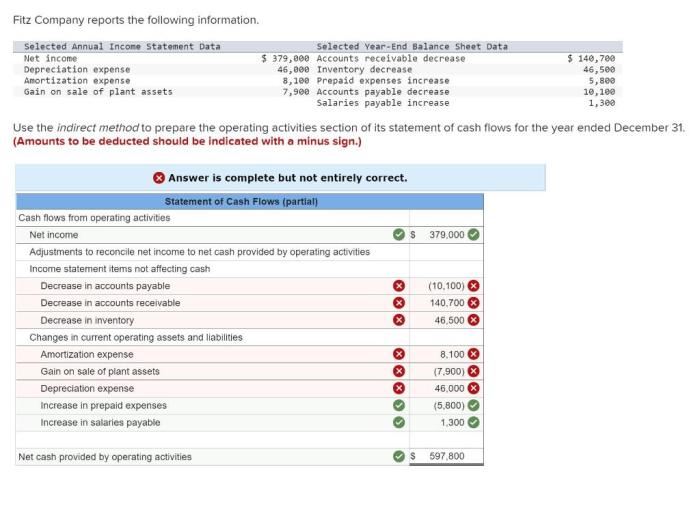

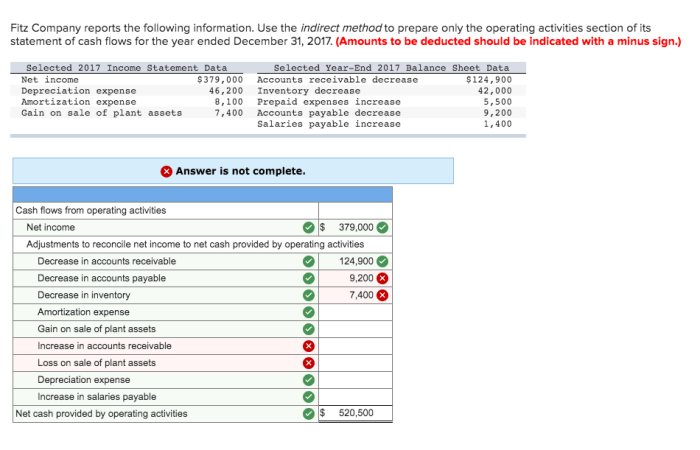

Cash Flow Statement

The cash flow statement reports the company’s cash inflows and outflows over a specific period of time. It shows how the company generates and uses cash from its operating, investing, and financing activities.

FAQ Compilation

What is the purpose of Fitz Company’s financial reporting?

Fitz Company’s financial reporting aims to provide stakeholders with a clear and comprehensive understanding of the company’s financial position, performance, and cash flows.

What key financial ratios are analyzed in the report?

The report analyzes key financial ratios, including liquidity ratios (e.g., current ratio, quick ratio), profitability ratios (e.g., gross profit margin, net profit margin), and solvency ratios (e.g., debt-to-equity ratio, times interest earned ratio).